Tap into funds as needed, only pay back what you use.

Every start-up needs a reliable financial safety net, and a business line of credit might just be the lifeline your venture needs to thrive. Unlike traditional loans that lock you into a fixed repayment schedule, a business line of credit offers flexibility by giving you access to a set amount of funds that you can draw from whenever needed. Whether it's to cover unexpected expenses, manage cash flow fluctuations, or seize new opportunities, a line of credit keeps your business fueled and ready to grow at your own pace.

A start-up BLOC works much like a credit card but with the added benefit of higher limits and, often, more favorable interest rates. You only pay interest on the amount you draw, not the full credit limit, which means you have the financial flexibility to borrow what you need, when you need it, and pay it back as your cash flow allows. This type of financing is especially useful for start-ups that experience seasonal fluctuations or need to bridge the gap between client payments and operational expenses.

At StartCap, we understand the unique challenges that start-ups face, which is why our BLOC solutions are tailored to provide the flexibility, security, and ease of access that every entrepreneur needs. With expert guidance, fast approvals, and a commitment to transparency, we make it easier for start-ups to manage cash flow without the pressure of a rigid loan structure. Ready to unlock your business's potential? Let’s explore how a business line of credit can keep your venture moving forward.

+ Plus you'll get a ton of FREE stuff.

For a very limited time and to really kick-start your business, our internal expert marketing team is going to give you 3-Months of FREE top-tier professional marketing to drive leads & sales.

Free Domain Name

Free Custom Website

Free Logo Design

Free Google Ads Management

Free Social Media Management

Free GMB Setup & Optimization

Free Professional SEO

Free Web Hosting

Free Directory Listings (100+)

That's $20k+ in free marketing + up to $500k in funding for everything else.

What is a Start-Up Business Line of Credit (BLOC)?

Picture your start-up as a space shuttle, poised on the launchpad, ready for takeoff. But, like any good shuttle, you need a little extra boost to get through the atmosphere—enter the start-up business line of credit. Think of it as your onboard fuel tank, giving you the extra thrust you need to handle those unexpected bumps in the journey or to accelerate when opportunity knocks. Unlike traditional loans that tie you down with a fixed trajectory, a line of credit offers the freedom to tap into funds as needed, keeping your start-up’s mission on course.

How Does a Business Line of Credit Work?

They operates like your mission’s auxiliary power unit—there when you need it but not burning fuel when you don’t:

- Approved Credit Limit: Once approved, your BLOC becomes your personal space station, stocked with funds ready for use. The credit limit is set based on your financial telemetry, such as your credit score and business history.

- Draw When Needed: You don’t have to blast off all at once. With a LOC, you can pull funds whenever your business needs a boost. It’s like firing your thrusters to adjust your orbit—just enough to keep things steady.

- Interest on the Drawn Amount: The beauty of this system? You only pay interest on the money you actually use, not the whole amount. It’s like paying for the rocket fuel you burn, not for the full tank sitting in reserve.

When Should You Consider Using a BLOC?

A start-up business line of credit is your go-to for those times when you need a little more power in your rocket boosters:

- Managing Cash Flow: When your new business hits some turbulence or drifts off course, a line of credit can help stabilize the flight.

- Unexpected Expenses: Perfect for when space debris (like unexpected bills) comes hurtling your way—this LOC helps you dodge and weave without losing momentum.

- Growth Opportunities: When a chance to expand your orbit presents itself, having access to quick funds means you can seize the moment and rocket forward.

Advantages

- Flexibility: You’re in control of the throttle—borrow what you need, when you need it, and keep your mission on track.

- Interest Savings: Only pay for the fuel you burn—saving resources for the big maneuvers.

- Revolving Credit: Repay what you’ve used, and your fuel tanks refill, ready for the next leg of the journey.

- Quick Access: Your LOC is always on standby, ready to power you through any challenges.

By understanding how a start-up business line of credit works, you can ensure your venture has the right amount of thrust to break through the atmosphere and explore new business horizons.

How Do I Qualify for a Business Line of Credit for My Start-Up?

Getting your start-up off the ground requires more than just a great idea—it often needs a solid financial foundation, too. Qualifying for a BLOC might seem like preparing for a space mission, but with the right preparations, you can ensure a smooth takeoff. Here's what you need to know to qualify and secure the financial flexibility that a business line of credit offers.

The Key Factors Lenders Consider

Lenders act like mission control when evaluating your application. They’re looking for specific data points to ensure your start-up has what it takes to handle a line of credit responsibly:

- Credit Score: Think of your score as the trajectory of your rocket. The higher your score, the smoother the ride. A strong score shows lenders that you’ve successfully managed credit in the past, making them more likely to approve your application.

- Business History: Lenders will want to see that your start-up has been orbiting the market for a while. Even if you’re a new business, having a solid business plan and showing consistent growth can help boost your chances.

- Revenue and Cash Flow: Just like a rocket needs fuel, your business needs cash flow to keep going. Lenders will look at your revenue streams to ensure you have the income to repay any borrowed funds. Consistent revenue and positive cash flow are strong indicators that you can handle an LOC.

- Collateral (Sometimes): While many new business lines of credit are unsecured, having collateral can be a bonus. If your start-up has assets like equipment or real estate, offering them as collateral can increase your chances of approval and might even get you better terms.

Steps to Improve Your Chances of Approval

Before you launch your application, make sure you’ve done the necessary pre-flight checks:

- Polish Your Credit Score: If your score needs a boost, take steps to improve it before applying. This might include paying down existing debt, correcting any errors on your report, and making sure you pay all your bills on time.

- Prepare Your Financial Documents: Lenders will want to see detailed financials, including profit and loss statements, balance sheets, and cash flow projections. Having these documents ready and accurate shows you’re serious and well-prepared.

- Craft a Solid Business Plan: A well-thought-out business plan is like a mission blueprint. It should outline your start-up’s goals, market analysis, and financial projections. This plan demonstrates to lenders that you’ve mapped out your journey and know how to reach your goals.

What If You’re a New Start-Up?

If your start-up is still in the early stages and doesn’t have much business history, don’t worry—you’re not grounded. Here’s how to increase your odds:

- Leverage Your Personal Credit: Your personal credit score may play a bigger role if your business is new. Ensure your personal credit is in good shape, as lenders will likely look at it to assess your creditworthiness.

- Showcase a Strong Team: Highlight the experience and expertise of your team. A strong management team can reassure lenders that your start-up has the leadership needed to succeed.

- Emphasize Your Market Opportunity: If your start-up is entering a hot market with high growth potential, make sure lenders understand this. A clear explanation of the market opportunity can offset the lack of business history.

How is a BLOC Different from a Traditional Business Loan?

Navigating the world of new business financing can feel a bit like steering a spacecraft through an asteroid field—choices are everywhere, and making the right one is crucial to avoid a crash landing. When it comes to funding your start-up, understanding the difference between a line of credit and a traditional business loan is key to charting the best course for your business’s success.

Flexibility: The Line of Credit Advantage

A start-up BLOC is like having a flexible propulsion system for your spacecraft. It gives you the power to adjust your speed and direction as needed, drawing funds when necessary and paying interest only on what you use. This makes it an ideal tool for managing cash flow, handling unexpected expenses, or seizing opportunities that come your way. You’re not locked into a fixed repayment schedule, which means you can use it whenever your business needs a quick boost.

In contrast, a traditional business loan is more like a powerful rocket booster—it provides a large sum of money upfront, but you’re committed to a set course with fixed monthly payments. While this can be beneficial for large, one-time expenses like purchasing equipment or funding a major expansion, it doesn’t offer the same level of flexibility. Once you’ve borrowed the money, you’ll need to start repaying it according to a predetermined schedule, regardless of how your cash flow changes.

Interest Rates and Repayment

With a LOC, you’re only paying interest on the amount you actually use, making it a cost-effective option for ongoing expenses or fluctuating needs. The revolving nature of a line of credit means that as you repay what you’ve borrowed, those funds become available again—like refueling your spacecraft mid-mission.

On the other hand, traditional business loans usually come with fixed interest rates and repayment terms. This can provide stability and predictability, which is great if you prefer to know exactly what your monthly payments will be. However, the total amount borrowed in a traditional loan is subject to interest from day one, which can add up quickly, especially if the funds are not immediately put to use.

When to Choose One Over the Other

Deciding between an LOC and a traditional business loan is like choosing between different propulsion systems for your spacecraft—each has its strengths depending on the mission:

- Line of Credit: Ideal for businesses that need ongoing access to funds, particularly if your cash flow is unpredictable or seasonal. It’s perfect for covering operational costs, managing short-term expenses, or taking advantage of unexpected opportunities.

- Traditional Business Loan: Best suited for large, planned expenses where you know exactly how much funding you need upfront. If you’re investing in a major purchase, such as new equipment or a property, and prefer the security of fixed payments, a traditional loan might be the better choice.

What Are the Interest Rates, Typically?

When considering a BLOC, one of the first things on your radar should be the interest rates—after all, those rates can determine how efficiently your business can navigate its financial orbit. Understanding the factors that influence these rates and what you can expect can help you plan your financial trajectory with confidence.

How Interest Rates Work for a Line of Credit

Interest rates function much like the gravity of a planet—it pulls on the amount you borrow, affecting how much you’ll eventually have to repay. The rate you’re offered can vary widely depending on several factors, including your creditworthiness, business history, and the overall economic climate.

- Variable Rates: Many business lines of credit come with variable interest rates, meaning they can fluctuate based on changes in the market. This is similar to how your spacecraft might drift slightly depending on external forces. While variable rates can start lower than fixed rates, they can increase over time, affecting your overall borrowing cost.

- Fixed Rates (Less Common): Some lenders may offer fixed interest rates, though this is less common. A fixed rate is like setting your autopilot—you know exactly what you’ll be paying, with no surprises down the road. However, these rates often start higher than variable ones, so it’s a trade-off between stability and potential savings.

Factors That Affect Your Interest Rate

Just like every space mission is unique, so too are the interest rates offered to different new businesses. Here are some factors that can influence the rate you’re offered:

- Credit Score: A higher credit score is like having a well-calibrated navigation system—it gives lenders confidence that you’ll stay on course. The better your score, the lower the interest rate you’re likely to receive.

- Business Financials: Lenders will look at your business’s financial health, including revenue, profit margins, and cash flow. Strong financials suggest your business is a reliable borrower, which can lead to more favorable interest rates.

- Economic Conditions: Interest rates can also be influenced by broader economic factors, like the Federal Reserve’s rates and market conditions. During periods of economic growth, rates might be higher, while in a downturn, they could be lower to encourage borrowing.

What You Can Expect

While exact rates can vary, you can generally expect the following:

- Small to Medium-Sized Businesses: Interest rates typically range from 5% to 20%, depending on the factors mentioned above. A business with strong financials and a solid score might find themselves on the lower end of that spectrum.

- Start-Ups or Riskier Ventures: If your start-up is still finding its footing, expect to be offered rates on the higher end. Lenders consider start-ups riskier investments, so they might charge more to offset that risk.

Managing Interest Rates to Your Advantage

Like a skilled astronaut managing fuel consumption, you can manage your interest rates to minimize costs:

- Draw Strategically: Only draw when necessary, and pay off what you borrow as quickly as possible to reduce interest costs.

- Negotiate Terms: If your business’s financial situation improves, don’t be afraid to negotiate for a better rate or shop around for a more competitive offer.

- Consider Timing: Keep an eye on the economic environment. If rates are expected to rise, it might be better to secure a line of credit sooner rather than later.

Can I Use a Business Line of Credit for Any Type of Start-Up Business Expense?

When it comes to financing your start-up, flexibility is key—just like a multi-tool that astronauts rely on for various tasks in space. A business line of credit is one such versatile tool, offering the flexibility to cover a wide range of business expenses. But are there any limits to what you can use it for? Let’s explore how you can deploy this financial resource across your business operations.

The Versatility of a Business Line of Credit

A BLOC is designed to be a flexible source of funding, much like a spacecraft’s thrusters that can be adjusted as needed. Here’s how you can use it to support your start-up’s various needs:

- Operational Expenses: From paying utility bills to covering payroll, it can help you manage day-to-day operations without disrupting your cash flow. It’s like having a steady supply of oxygen in your space suit—keeping everything running smoothly.

- Inventory Purchases: Whether you need to stock up on products or materials, it gives you the ability to purchase inventory as needed, especially during peak seasons. It’s like refueling your rocket before a long mission.

- Marketing and Advertising: Ready to launch a new campaign? Use your credit line to fund marketing efforts that can boost your brand visibility and drive sales. Think of it as the booster rockets that propel your business into the market.

- Emergency Repairs: Sometimes, unexpected issues arise, like equipment breakdowns or urgent repairs. A line of credit ensures you have the funds available to address these emergencies without derailing your mission.

Strategic Uses for Growth and Expansion

A business line of credit isn’t just for keeping the lights on—it can also be a powerful tool for growth. Here’s how you can use it strategically:

- Expanding Operations: If you’re looking to expand your business, whether it’s opening a new location or launching a new product line, a credit line provides the financial backing you need to take that leap. It’s like upgrading your spacecraft for a longer, more ambitious journey.

- Seizing Opportunities: Business opportunities can appear out of nowhere, much like a sudden discovery of a new planet. With a LOC, you have the financial flexibility to seize these opportunities as they arise, without having to scramble for funding.

- Cash Flow Management: Even the most well-planned missions can encounter delays or unexpected expenses. A business line of credit can smooth out cash flow fluctuations, helping you stay on course and avoid the turbulence of financial shortfalls.

What You Shouldn’t Use a Line of Credit For

While a BLOC is versatile, there are some things it’s not suited for:

- Long-Term Investments: A line of credit is best for short-term needs. Using it for long-term investments, like buying real estate, might lead to higher interest costs over time, like burning through fuel too quickly on a long journey.

- Personal Expenses: Keep the funds strictly for business use. Mixing personal and business finances can complicate your financial situation and might even lead to legal issues—like accidentally mixing up mission logs and personal journals.

How Long Does It Take to Get Approved?

When you’re running a start-up, time is of the essence—every moment counts when you’re aiming for the stars. So, how long does it take to get your business line of credit approved? The answer isn’t as straightforward as launching a rocket, but with the right preparations, you can speed up the process and get the funds you need to fuel your mission.

The Approval Process: What to Expect

The approval process for a business line of credit can vary depending on several factors, including the lender, the amount requested, and your business’s financial health. Here’s a general breakdown of what you can expect:

- Initial Application: The first step in the process is filling out the application, which usually takes just a few minutes. You’ll need to provide basic information about your business, along with your credit report and sometimes a tax return. It’s like submitting your flight plan before takeoff—laying out the details so the mission can proceed smoothly.

- Review and Verification: Once your application is submitted, the lender will review your information. This step can take anywhere from a few days to a couple of weeks, depending on the lender’s process and the complexity of your application. Think of it as the pre-launch checklist—ensuring everything is in order before the final countdown.

- Approval Decision: After reviewing your application and verifying your information, the lender will make a decision. If approved, you’ll receive the terms of your line of credit, including the credit limit, interest rate, and repayment terms. This decision can come quickly if your application is straightforward and your business is in good financial shape—like a rocket that’s cleared for launch.

Factors That Can Speed Up the Process

While you can’t always control how long the approval process will take, there are steps you can take to help speed things along:

- Prepare Your Documents: Having your credit report and tax returns ready and organized before applying can save time. It’s like packing your spacesuit and tools in advance—being prepared ensures a quicker launch.

- Maintain a Good Score: A strong score can significantly speed up the approval process, as it gives lenders confidence in your ability to manage credit responsibly. Keeping your credit in good shape is like ensuring your spacecraft is in top condition—ready to pass all inspections.

- Choose the Right Lender: Some lenders are faster than others, particularly those who specialize in small businesses and start-ups. Doing a little research to find a lender known for quick approvals can shave days, or even weeks, off the process. It’s like choosing the most efficient launch pad—one that gets you off the ground faster.

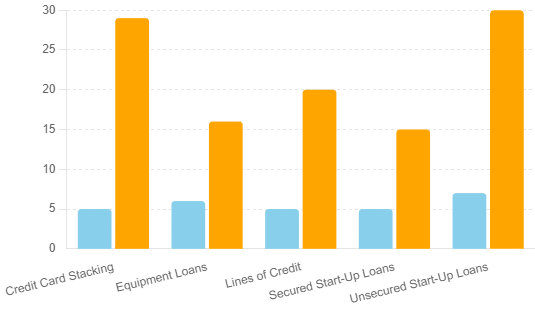

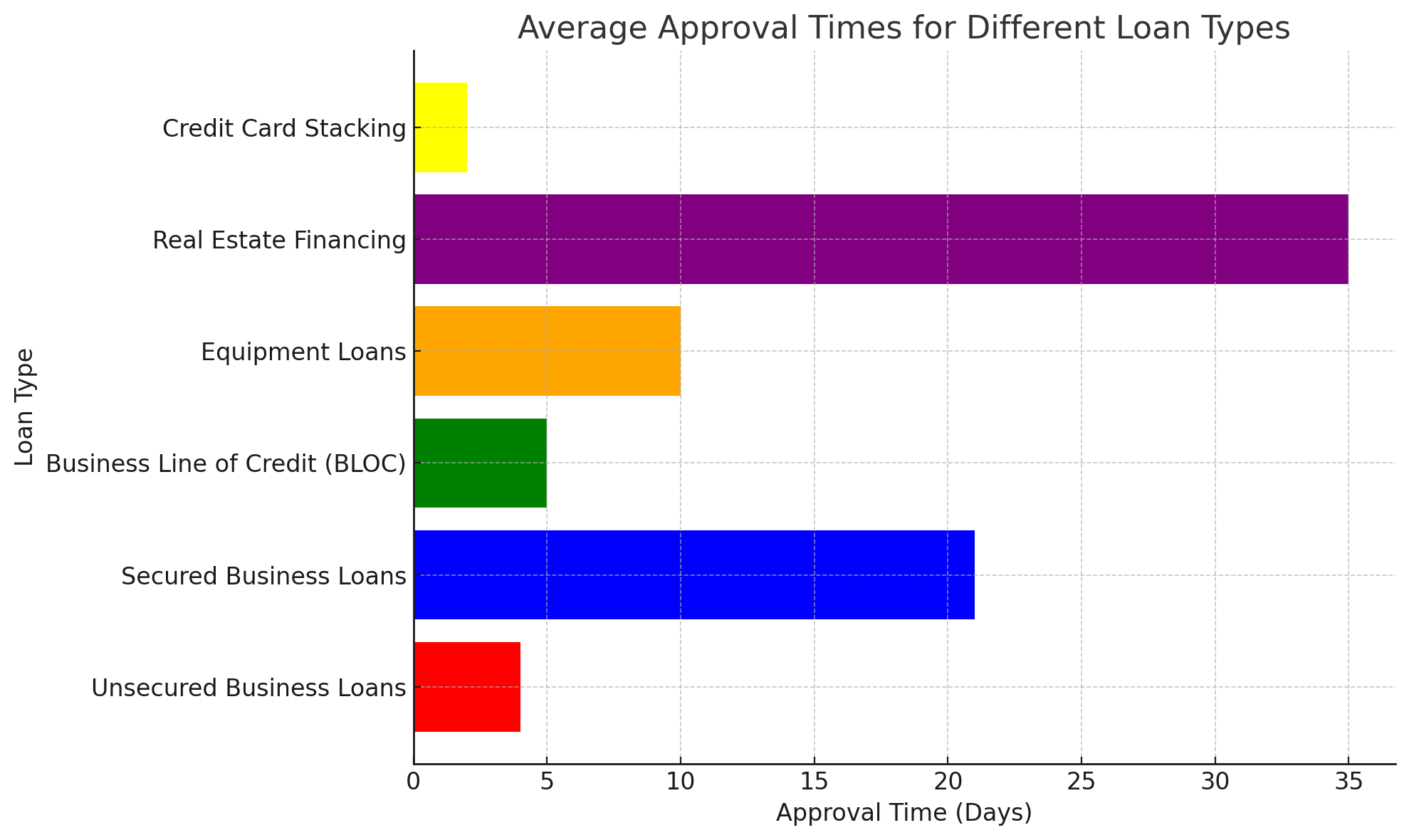

Typical Approval Timeframes

Here’s a general idea of how long it might take to get approved:

- Online Lenders: 1 to 3 business days. Online lenders often have streamlined processes that can get you approved quickly, especially if you’re applying for a smaller line of credit.

- Traditional Banks: 1 to 3 weeks. Banks typically have more rigorous review processes, which can take longer, especially for larger lines of credit.

- Credit Unions: 1 to 2 weeks. Unions often offer competitive rates, but their approval process can be slower than online lenders, though usually faster than traditional banks.

While the approval process for a business line of credit can vary, being well-prepared and choosing the right lender can help you get the funds you need quickly. By understanding the steps involved and what you can do to expedite the process, you’ll be better positioned to secure the financial support your start-up needs to keep its mission on track.

How Much Can I Borrow with a Start-Up Business Line of Credit?

When it comes to fueling your start-up’s journey, the amount of funding available to you is like the size of your rocket’s fuel tank—essential for determining how far and how fast you can go. So, how much can you actually borrow? The answer depends on several factors, but understanding these will help you set realistic expectations and plan your mission accordingly.

Factors That Determine Your Credit Limit

The limit you’re offered isn’t arbitrary; it’s based on a combination of factors that lenders use to assess your business’s financial health and borrowing capacity. Here are the key elements that will influence how much you can borrow:

- Credit Score: Your score is like the calibration of your navigation system—the higher it is, the more confident lenders will be in offering you a larger credit limit. A strong credit score signals that you’ve managed credit well in the past, making lenders more likely to trust you with a higher limit.

- Business Revenue: Lenders want to ensure that your business has enough income to repay any borrowed funds. If your start-up has consistent and growing revenue, you’re more likely to be offered a higher credit limit, as it shows that your business has the fuel to sustain itself.

- Cash Flow: Just like a well-maintained rocket engine, strong cash flow indicates that your business can manage its financial obligations effectively. Lenders will assess your cash flow to determine how much credit you can handle without putting your business at risk.

- Collateral (If Applicable): While many business lines of credit are unsecured, offering collateral (such as equipment or real estate) can increase your credit limit. Think of collateral as extra thrusters—it gives your lender additional security, which might translate into more available credit.

Typical Credit Limits for Start-Ups

While limits can vary widely depending on the factors mentioned above, here’s a general idea of what you might expect:

- Small Start-Ups: If your business is still in its early stages and doesn’t have a long financial history, you might be offered a credit limit ranging from $10,000 to $50,000. This is enough to cover operational expenses and short-term needs as you work on growing your revenue.

- Established Start-Ups: If your start-up has been in operation for a few years with steady revenue, you could be looking at a credit limit between $50,000 and $250,000. This allows for greater financial flexibility, enabling you to take on larger projects or manage more substantial cash flow fluctuations.

- Larger Businesses: For start-ups that have already achieved significant revenue and have a strong financial track record, credit limits can go even higher—up to $500,000 or more. This level of credit can support major expansions, acquisitions, or other large-scale investments.

How to Maximize Your Credit Limit

If you’re aiming for a higher limit, there are steps you can take to increase your chances:

- Improve Your Score: Focus on maintaining a strong score by paying bills on time, reducing outstanding debt, and correcting any errors on your credit report. The better your score, the more credit you’re likely to receive.

- Demonstrate Strong Financials: Lenders are more likely to offer higher credit limits to businesses with solid financial statements and consistent cash flow. Ensure your financial records are accurate and up to date.

- Offer Collateral: If you have valuable business assets, offering them as collateral can boost your limit. It provides additional security for the lender and increases their confidence in your ability to repay.

Is a BLOC Right for your Start-Up?

Securing the right financial tools for your start-up is akin to charting a course through the vast expanse of space. Whether it’s understanding the intricacies of a business line of credit, comparing it to traditional loans, or maximizing your borrowing potential, each decision plays a crucial role in propelling your venture forward. A BLOC offers the flexibility and agility that every start-up needs—much like the adjustable thrusters on a spacecraft, allowing you to maneuver through both challenges and opportunities.

As you embark on your entrepreneurial journey, remember that your financial strategy is your mission control. By understanding the factors that influence your credit options, being prepared for the application process, and strategically using the funds available to you, you can ensure your start-up remains on a steady trajectory toward success. At StartCap, we’re here to support your mission every step of the way, providing the guidance, resources, and financial tools you need to reach new heights.

So, strap in, adjust your flight path as needed, and keep your eyes on the stars—your start-up’s journey is just beginning, and with the right financial foundation, there’s no limit to how far you can go.

Community Q & A

Support@StartCap.org