When you need extra fuel, on-demand.

Business credit card stacking for your start-up offers a unique and powerful tool for entrepreneurs looking to maximize their funding without the usual constraints (think of it as your financial Swiss Army knife—small, versatile, and incredibly handy). This approach involves strategically utilizing multiple cards to secure an overall higher access to funds, propelling your business forward with the kind of financial flexibility that would make a yoga instructor jealous.

This page is dedicated to exploring the strategic application of business credit stacking for start-ups. We’ll dive into its mechanics, benefits, and the careful considerations required to optimize its potential (because let’s face it, no one wants to stack cards only to watch them topple like a game of Jenga). From understanding how to select the right cards for your business needs to managing your new credit portfolio effectively, we provide thorough insights to guide your decision-making process—no financial guesswork required.

At StartCap, we offer innovative solutions like business credit card stacking to help you maximize your financial potential (because who doesn’t want to squeeze every last drop of funding potential?). Our approach allows you to strategically leverage multiple credit cards, giving your start-up the flexibility to access the capital it needs without the constraints of collateral, lengthy approval processes, or fixed monthly payments on lump sum loans. With StartCap, you benefit from expert guidance, tailored strategies, and a commitment to transparency, ensuring that you can confidently use credit stacking to fuel your business’s launch and growth—kind of like rocket fuel, but with fewer combustion risks.

Plus — you'll get a ton of FREE stuff.

For a very limited time and to really kick-start your business, our internal expert marketing team is going to give you 3-Months of FREE top-tier professional marketing to drive leads & sales.

Free Domain Name

Free Custom Website

Free Logo Design

Free Google Ads Management

Free Social Media Management

Free GMB Setup & Optimization

Free Professional SEO

Free Web Hosting

Free Directory Listings (100+)

That's $20k+ in free marketing + up to $500k in funding for everything else.

What is Business Credit Stacking?

It's a funding strategy that involves leveraging multiple cards or lines to maximize your available funding. Instead of applying for a single large loan, which might be challenging for a start-up to secure, you apply for several. Each card contributes to your overall limit, effectively allowing you to access a larger pool of funds. This method can be particularly advantageous for new businesses that need flexible financing options without the need for collateral or requiring fixed monthly payments, which can be challenging for new businesses.

How Does Business Credit Stacking Work?

Credit stacking works by strategically applying for and using multiple cards. Here's how it typically unfolds:

- Application Process: You apply for several business credit cards, ideally within a short period, to increase the chances of approval before new accounts affect your score.

- Combining Limits: Once approved, you can combine the limits of these cards to create a substantial amount of available funds. For example, if you have three cards with $10,000 limits, you effectively have access to $30,000.

- Using the Credit: These funds can be used to cover various business expenses, from purchasing inventory and equipment to funding marketing campaigns or managing cash flow.

Advantages of Business Credit Stacking

Stacking offers several key benefits:

- No Collateral Required: Unlike traditional loans, stacking doesn't require you to put up personal or business assets as collateral.

- Flexible Use of Funds: The funds accessed through stacking can be used for a wide range of business needs, offering flexibility that other financing options may not.

- Building Business Credit: By responsibly managing multiple accounts, you can build and strengthen your business profile, which can help you secure larger financing options in the future.

Potential Risks and Considerations

While business credit stacking can be an effective funding strategy, it’s important to consider the potential risks:

- Interest Rates: Credit cards typically have higher interest rates compared to traditional loans. If you carry a balance, the interest charges can add up quickly.

- Payment Management: With multiple cards, keeping track of payment due dates and amounts can become complex. Missing payments can lead to fees and damage your score.

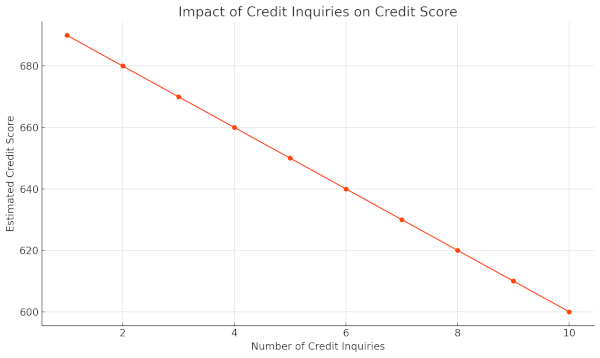

- Impact on Score: Applying for multiple cards in a short time can lead to multiple hard inquiries on your report, which may temporarily lower your score.

Is Business Credit Stacking Right for Your Start-Up?

Stacking can be a powerful tool for start-ups, especially those in need of flexible and accessible funding. However, it’s crucial to approach this strategy with a clear plan and a strong understanding of your financial management capabilities. If you can manage multiple accounts responsibly and handle the associated costs, credit stacking can provide the financial boost your start-up needs to launch and grow.

Can I Stack Both Personal and Business Credit?

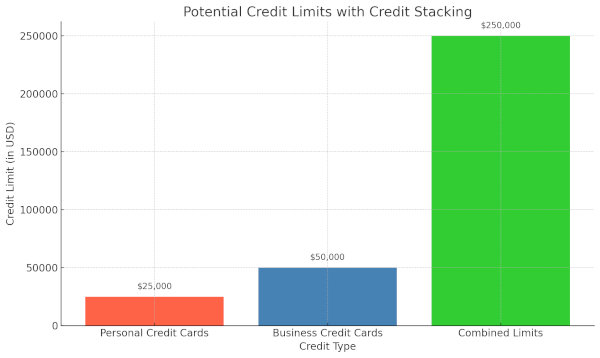

Yes, you can stack both to maximize your available funding. This approach involves strategically applying for and using a combination of personal and business credit cards to increase your overall credit limit. By leveraging both types of credit, you can access a larger pool of funds, giving your start-up the financial flexibility it needs to cover a wide range of expenses.

How Does Stacking Both Personal and Business Credit Work?

Stacking both works similarly to traditional stacking but with the added advantage of drawing from two different sources. Here’s how it typically works:

- Apply for Multiple Cards: You start by applying for several business credit cards, as well as personal. Each card contributes to your total available funding.

- Combine Limits: Once approved, you can combine the limits from both personal and business cards, effectively increasing your purchasing power.

- Use Funds Strategically: These funds can be used to cover various business expenses, such as operational costs, marketing campaigns, or even emergency expenditures. The key is to use the funds strategically to ensure your start-up’s growth.

Benefits of Stacking Both Personal and Business Credit

- Increased Availability: By stacking both, you can significantly increase your total available funding, giving your start-up access to more funds.

- Greater Flexibility: Combining both provides more flexibility in how you manage and allocate funds across different aspects of your business.

- Builds Both Profiles: Managing both personal and business credit responsibly can help build and strengthen your profiles, making it easier to secure larger financing options in the future.

Considerations and Risks

While stacking both personal and business credit can be a powerful strategy, it’s important to approach it with caution:

- Impacts: Using personal credit cards for business expenses can impact your personal score, especially if you carry high balances or miss payments.

- Complex Financial Management: Managing multiple accounts can become complex, requiring careful attention to payment schedules and credit utilization.

- Higher Risk of Debt Accumulation: With increased access to credit comes the risk of accumulating more debt. It’s essential to have a clear plan for managing and repaying the debt to avoid financial strain.

Is Stacking Both Personal and Business Credit Right for You?

Stacking both of them can be a valuable strategy for start-ups that need additional funding and have the financial discipline to manage multiple credit accounts. However, it’s important to weigh the benefits against the potential risks. If managed carefully, this approach can provide the financial flexibility your start-up needs to grow and succeed.

By considering these factors and working with a trusted partner like StartCap, you can make informed decisions and leverage the combined power of personal and business credit stacking to fuel your start-up’s journey.

How Much Can I Get with Credit Stacking?

The total amount you can access through depends on several factors, including your personal and business credit scores, the types of credit cards you apply for, and how many cards you are approved for.

Factors That Influence Your Credit Stacking Potential

1. Credit Score

Your personal and business scores play a significant role in determining the limits you can obtain. Higher credit scores typically lead to higher limits and more favorable terms. If you have a strong history, you may qualify for cards with substantial limits, allowing you to stack more effectively.

2. Types of Cards

The types of cards you choose to stack can also impact the total amount of funds you can access. Business credit cards often come with higher limits than personal. Additionally, premium cards or those designed for businesses may offer larger limits compared to standard cards.

3. Number of Approved Cards

The more cards you are approved for, the more credit you can stack. However, it's important to balance the number of cards with the ability to manage them effectively. While stacking multiple cards increases your available funding, it also requires careful financial management to avoid the risks associated with carrying multiple balances.

Average Credit Stacking Amounts

While the exact amount you can obtain through varies, businesses often see the following ranges:

- Personal: Typically, individual card limits can range from $5,000 to $25,000, depending on your creditworthiness and the card issuer.

- Business: Business cards often offer higher limits, ranging from $10,000 to $50,000 or more, especially for those with strong business credit.

- Combined Limits: By stacking multiple cards, it's common to access $100,000 to $250,000 or more in total, depending on the number of cards and their respective limits.

Maximizing Your Stacking Potential

To maximize the amount you can obtain through stacking, consider the following strategies:

- Apply for a Mix of Personal and Business Cards: Combining personal and business credit cards can increase your total available credit. Business cards typically offer higher limits, which can significantly boost your stacking potential.

- Optimize Your Score: Before applying for multiple cards, take steps to improve your score. Paying down existing debt, correcting any errors on your report, and maintaining a low utilization ratio can help you qualify for higher limits.

- Strategic Timing: Apply for multiple cards within a short period to increase the likelihood of approval before new accounts affect your score. This approach can help you stack more effectively.

Is There a Limit?

While there is technically no cap on the number of cards you can stack, practical limitations do exist. These include your ability to manage multiple accounts, the cumulative impact on your score, and the risk of overextending your finances. It's crucial to approach credit stacking with a clear strategy and a realistic understanding of your financial situation to ensure it benefits your start-up without introducing undue risk.

What Are the Risks of Business Credit Stacking?

Business credit stacking can be a powerful tool for accessing the funds your start-up needs, but it also comes with several risks that should be carefully considered before diving in. Understanding these risks can help you make informed decisions and avoid potential pitfalls that could harm your business in the long run.

High Interest Rates

While many cards have an introductory offer of 0% for up to 24 months, one of the most significant risks associated with card stacking is the high interest rates typically charged by credit cards after the offer expires. Unlike traditional loans, credit cards often come with variable interest rates that can increase over time. If you're unable to pay off your balances quickly, the accumulated interest can lead to substantial debt, eating into your business's profits and cash flow.

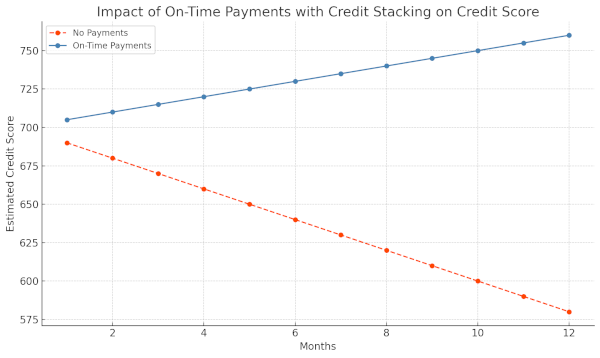

Impact on Scores

Applying for multiple credit cards in a short period can result in multiple hard inquiries on your report, which may temporarily lower your credit score. Additionally, high credit utilization—using a large percentage of your available credit—can negatively impact your credit score. This could make it more difficult to secure additional financing in the future and may affect your ability to negotiate favorable terms with lenders.

Complex Financial Management

Managing multiple cards requires careful attention to payment schedules, due dates, and limits. Missing a payment or exceeding a credit limit can lead to costly fees, higher interest rates, and potential damage to your credit profile. The complexity of managing several accounts can also increase the likelihood of errors, making it essential to have a solid financial management system in place. It's highly recommended to setup auto-pay to ensure on-time payments, which will actually build credit over time.

Risk of Debt Accumulation

The ease of access to credit through stacking can lead to overspending and accumulating more debt than your business can handle. Without disciplined financial management, you could find yourself struggling to make payments, which can result in mounting interest charges and fees. Over time, this can put significant strain on your business’s finances and potentially lead to insolvency.

Potential for Limited Cash Flow

While credit stacking provides access to a larger pool of funds, relying too heavily on it can tie up your cash flow. If you're using credit to cover everyday operational expenses, you may find yourself in a situation where your cash flow is insufficient to meet your obligations, leading to a cycle of debt that becomes increasingly difficult to break.

Difficulty in Obtaining Future Financing

If your business relies too heavily on stacking, it may become more challenging to secure traditional financing in the future. Lenders may view your high levels of credit card debt as a sign of financial instability, making them hesitant to offer additional loans or lines of credit. This can limit your options for growth and expansion as your business matures.

Is Business Credit Stacking Legal?

Yes, it is legal. It’s a legitimate strategy that many entrepreneurs and small business owners use to access additional funding. By applying for and managing multiple credit cards, you can effectively increase your available credit, which can be particularly useful for start-ups that may not yet qualify for large loans or lines of credit. However, while credit stacking is legal, there are important considerations to keep in mind to ensure that you're using this strategy responsibly and within the bounds of the law.

Legal Considerations

1. Honest Applications

Always provide accurate and truthful information when applying to avoid legal issues.

2. Compliance with Agreements

Adhere to the terms and conditions of each card to avoid penalties, interest rate increases, or account closures.

3. Financial Responsibility

Manage your debt carefully and ensure you have a solid repayment plan to avoid financial strain.

4. Impact on Personal Credit

Remember that stacking both personal and business cards can affect your personal credit, so manage both responsibly.

The Role of Ethical Practices

Using business card stacking ethically is as important as ensuring its legality. This means not only adhering to the terms and conditions set by card issuers but also managing your finances in a way that reflects good business practices. Ethical management helps maintain your credibility with lenders and ensures that your business remains in good financial health.

When to Seek Professional Advice

Given the complexities involved in managing multiple cards, it’s often wise to seek professional advice before engaging in credit stacking. Specialists, like those at StartCap, can help you navigate the process, ensuring that you make informed decisions that align with your business’s goals and financial capabilities.

Can Business Credit Stacking Affect My Personal Score?

Yes, business stacking can affect your personal score, especially if you're using personal cards as part of your stacking strategy. While the goal of business credit stacking is to increase your available business funds, the way you manage both personal and business accounts can have a significant impact on your personal score.

How Business Card Stacking Impacts Personal Credit

1. Personal Utilization

If you're using personal cards for business expenses, the balances on these cards will contribute to your overall utilization rate. A high utilization rate—using a large percentage of your available limit—can negatively impact your personal score. It’s generally recommended to keep your utilization below 30% of your total limit to maintain a healthy score.

2. Payment History

Payment history is a critical factor in your personal score. If you miss payments on any of your personal cards used in stacking, it will be reported to the bureaus and can significantly damage your score. Ensuring that all payments are made on time is essential to protecting your credit.

3. Hard Inquiries

Applying for multiple cards in a short period can result in several hard inquiries on your report. Each hard inquiry can lower your score by a few points, and multiple inquiries can have a more substantial impact, especially if your score is already on the lower side.

4. Impact of Business Debt on Personal Credit

If you’re personally guaranteeing your business cards, any debt you accrue on those cards could potentially affect your personal score if payments are missed or if you default on the credit. This intertwines your business and personal finances, making it crucial to manage both carefully.

How to Mitigate the Impact on Your Personal Credit

1. Separate Business and Personal Finances

Whenever possible, use business cards exclusively for business expenses to keep personal and business finances separate. This can help protect your personal score from being affected by your business's activities.

2. Monitor Utilization

Keep a close eye on your utilization rates for both personal and business cards. Aim to keep utilization low, ideally below 30%, to avoid negative impacts on your score.

3. Make Timely Payments

Set up automatic payments or reminders to ensure that you never miss a payment on any of your cards. Consistently making on-time payments is one of the best ways to maintain a strong score.

4. Be Strategic About Applications

To avoid too many hard inquiries, be strategic about when and how often you apply for new cards. Spacing out applications and focusing on cards that offer the best terms for your needs can help minimize the impact on your score.

Are There Any Alternatives to Credit Stacking?

Yes, there are plenty of alternatives to stacking that you can consider for funding your start-up. Think of credit stacking as one tool in your entrepreneurial toolbox—there are many other tools out there, and sometimes, a wrench is better than a hammer (especially if you’re trying to avoid hitting your thumb). Depending on your business needs and financial situation, these alternatives might offer a more suitable or less risky way to secure the capital you need.

1. BLOC

A business line of credit is like having a trusty backup plan in your pocket. It gives you flexible access to funds up to a predetermined limit, just like cards, but often with lower interest rates. You can draw funds as needed and only pay interest on the amount you use. It’s like having a financial safety net that doesn’t involve performing a high-wire act with your score.

2. Traditional Business Loans

If you prefer the security of a set amount with predictable payments, a traditional business loan might be your cup of tea. These loans give you a lump sum upfront, which you repay over time with interest. It’s kind of like getting a birthday gift of cash—but with a repayment plan. The interest rates are usually lower than those of cards, so it’s easier on your wallet (and your stress levels).

3. SBA Loans

For those who like the idea of a government-backed boost, SBA loans are like getting a little help from Uncle Sam. These loans offer lower interest rates and longer repayment terms, but they do require more paperwork. If you’re up for the challenge of navigating the bureaucracy, an SBA loan can be a great alternative—just make sure you have a comfy chair and a good pen ready for all that paperwork.

4. Equipment Financing

If your start-up needs shiny new gear, equipment financing could be the way to go. It’s like a layaway plan for business equipment, where the gear itself serves as collateral. This reduces the lender’s risk and can result in lower interest rates. Plus, you get to feel like a kid on Christmas morning when that new equipment arrives!

5. Angel Investors and Venture Capital

For those with big dreams (and the business plans to match), seeking investment from angel investors or venture capitalists might be the ticket. These investors bring more than just money—they bring expertise, connections, and maybe even a little bit of glamour to your start-up story. Just remember, you’ll be sharing your success with your new business partners—think of it as inviting some extra chefs into your kitchen.

6. Crowdfunding

Crowdfunding is like throwing a party and asking everyone to pitch in for pizza. It’s a way to raise money without taking on debt or giving up equity, but it does require a great pitch and a knack for engaging people. If you’ve got the charm and the vision, crowdfunding could be your alternative to credit stacking—and maybe even a fun way to build a community around your start-up.

7. Invoice Financing

If your customers are taking their sweet time to pay up, invoice financing lets you get the cash you need now instead of waiting. It’s like getting an advance on your paycheck—but with your customers’ money. The lender gives you a percentage of the invoice amount, and then collects payment directly from your customers. It’s a quick fix for slow payers, so you can keep the lights on while you wait for your customers to come through.

8. Merchant Cash Advances

A merchant cash advance is like getting a cash boost in exchange for a slice of your future sales. It’s great if your business has steady credit card sales, but be warned—it can come with higher fees. It’s a bit like eating dessert before dinner: it’s satisfying in the moment, but you might regret it later if you’re not careful.

Choosing the Right Option for Your Start-Up

The best alternative to credit stacking depends on your business’s unique needs, financial situation, and how much risk you’re willing to take. Whether you’re looking for stability, flexibility, or just a bit of quick cash, there’s an option out there for you. At StartCap, we’re here to help you explore these alternatives—think of us as your financial GPS, guiding you to the funding solution that’s right for your start-up’s journey to success.

Community Q & A

Support@StartCap.org