Secured Business Loans: A Lifeline for Growing Start-Ups

Launching a start-up is an exciting yet challenging venture and often requires significant financial backing to get off the ground. For entrepreneurs seeking substantial funding with lower interest rates and longer repayment terms, secured business loans offer a reliable solution. By leveraging assets like equipment, real estate, or inventory as collateral, you can access the capital your start-up needs to thrive while potentially reducing the cost of borrowing.

Secured business loans are particularly beneficial for start-ups that have valuable assets but need more liquidity to fuel growth. Whether you’re looking to expand operations, purchase new equipment, or stabilize cash flow, a secured loan can provide the financial security and flexibility to turn your business vision into reality. At StartCap, we understand the unique challenges faced by start-ups, and our secured loan options are designed to help you navigate these challenges with confidence.

With a secured business loan, you’re not just investing in your start-up’s present; you’re securing its future. Let’s explore how this type of financing can give your start-up the boost it needs to reach new heights. At StartCap, we specialize in start-up funding for new businesses, such as secured loans as well as other loan types, including loan stacking to maximize funding.

Plus — you'll get a ton of FREE stuff.

For a very limited time and to really kick-start your business, our internal expert marketing team is going to give you 3-Months of FREE top-tier professional marketing to drive leads & sales.

Free Domain Name

Free Custom Website

Free Logo Design

Free Google Ads Management

Free Social Media Management

Free GMB Setup & Optimization

Free Professional SEO

Free Web Hosting

Free Directory Listings (100+)

That's $20k+ in free marketing + up to $500k in funding for everything else.

What is a Secured Business Loan, and How Does It Work?

A secured business loan is like a safety harness for your start-up’s finances. It’s a type of financing that requires you to provide collateral—think of it as the solid ground under your feet (or the landing pad for your rocket). Whether it’s equipment, real estate, or inventory, this collateral reduces the risk for the lender, which often results in lower interest rates, larger loan amounts, and longer repayment terms compared to unsecured loans. It’s a win-win—unless you forget to repay, in which case, the lender gets to keep your landing pad.

How Does a Secured Business Loan Work?

When you apply for a secured business loan, the lender will assess the value of the collateral you’re offering—essentially making sure your rocket is in good shape before liftoff. The amount of the loan is usually based on a percentage of the collateral’s value, known as the loan-to-value (LTV) ratio. For example, if you’re offering equipment worth $100,000 as collateral, and the lender’s LTV ratio is 80%, you could potentially borrow up to $80,000. So, the better your rocket, the higher you can fly.

Once approved, you’ll receive the loan amount in a lump sum, which you can use for various business needs—whether that’s fueling your growth, expanding operations, or just making sure your start-up doesn’t run out of oxygen. You’ll make regular payments over the agreed term, which typically includes both principal and interest—so don’t forget to budget for that extra weight on your journey.

Benefits of Secured Business Loans

- Lower Interest Rates: Because it's is backed by an asset, lenders face less risk and can offer lower interest rates, saving you money over the life of the loan. It’s like getting a discount on rocket fuel—more power for less money.

- Larger Amounts: Secured loans often allow you to borrow more than you could with an unsecured loan, giving your start-up the financial boost it needs to grow. Think of it as upgrading your thrusters to reach escape velocity.

- Longer Repayment Terms: With the security of collateral, lenders may offer longer repayment terms, making monthly payments more manageable and reducing the strain on your cash flow. It’s like extending your mission timeline so you can explore more of the financial galaxy.

Potential Risks

- Loss of Asset: If you’re unable to repay the loan, the lender can seize the asset—so make sure you don’t put up your prized rocket engine unless you’re confident in your flight plan.

- Complex Application Process: Secured business loans typically require more documentation and a more thorough review process, which can take longer compared to unsecured loans. Think of it as the pre-flight checks—necessary, but sometimes a bit tedious.

- Impact on Credit: While the asset reduces the lender’s risk, defaulting can still negatively impact your business’s credit score—grounding your future financial flights.

Is a Secured Business Loan Right for You?

Secured business loans can be an excellent option for start-ups that have valuable assets and need significant capital at a lower cost. However, it’s essential to weigh the benefits against the risks and consider your ability to meet the repayment terms. If you’re confident in your business’s ability to generate the revenue needed to repay the loan, a secured business loan could be the key to unlocking new opportunities and driving growth—just make sure your rocket is ready for the journey!

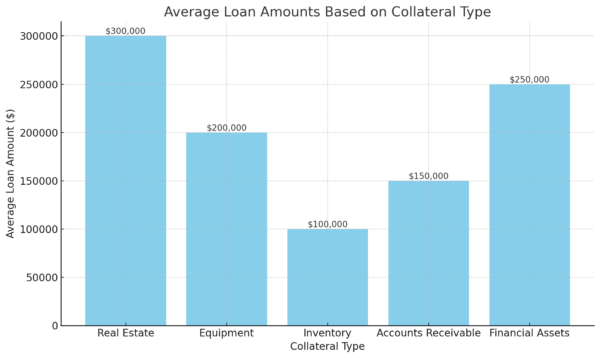

What Types of Assets Can I Use for a Secured Business Loan?

When it comes to a secured business loan, your asset is like the rocket fuel that powers your financial journey. The better, the more likely you are to get the funding you need to reach new heights. But what exactly can you use as collateral for a secured business loan? Let’s explore the types of assets that can boost your chances of approval and get your start-up off the ground.

Common Types of Collateral

- Real Estate:

Whether it’s commercial property or land, real estate is a prime asset. Lenders love it because it tends to hold its value—and let’s face it, nothing says “secure investment” like a chunk of the Earth itself. Just remember, if things go south, your lender might end up with a new office. - Equipment:

From manufacturing machinery to computers, equipment can be a solid choice. Lenders will typically appraise the equipment’s value before approving the loan. So, if your business runs on high-quality gear, you’re in good shape. Just make sure you don’t pledge your only working computer—running a start-up without one could be tricky! - Inventory:

Got stock? Inventory is another option, but it should be high-end. Lenders might make an offer based on the value of your inventory, though they’ll likely be conservative with their estimates. So, if you’re sitting on a warehouse full of unsold products, this could be your ticket to securing that loan—just don’t get too attached to that inventory if you can’t make the payments. - Accounts Receivable:

If your customers owe you money, you can use those unpaid invoices as collateral. This is a common option for businesses that have a steady stream of receivables but need cash now. It’s like getting paid upfront for work you’ve already done—minus the “hassle” of actually collecting the payments yourself. - Personal Assets:

In some cases, especially for start-ups, you might need to put personal assets on the line. This could include your home, car, or other valuable personal property. It’s a higher-risk option, but if you believe in your business, it could be the push you need to get that funding. Just be sure you’re ready to back up your belief with something tangible.

What Makes Good Collateral?

Something with a stable or appreciating value and is easy to sell if necessary. Lenders prefer assets that are in good condition, have a clear ownership history, and are relatively liquid—meaning they can be quickly converted to cash if needed. So, while your prized collection of vintage action figures might be valuable to you, they probably won’t cut it as collateral (unless your lender happens to be a serious collector).

How to Choose the Right Asset

When deciding what to offer, consider the following:

- Value vs. Loan Amount: The value of your asset will often determine how much you can borrow. Make sure your assets are appraised accurately and that they’re sufficient to cover the loan amount you’re seeking.

- Risk vs. Reward: Understand the risk involved in using specific assets. If your business hits a rough patch, could you afford to lose the asset? Choose assets that you can part with if things don’t go as planned, but also ones that hold enough value to secure the loan you need.

- Personal vs. Business Assets: Weigh the pros and cons of using personal assets versus business assets. While personal assets might help you secure a larger loan, they also come with a greater personal risk.

What Are the Interest Rates Typically Like for Secured Business Loans?

When you’re financing your start-up, the interest rate on a secured business loan can determine how smooth your financial journey will be. Secured business loans generally offer more favorable interest rates compared to unsecured loans, but how exactly are these rates determined, and what can you expect? Let’s explore the factors that influence interest rates on secured loans and what you can do to secure the best deal.

Why Secured Business Loans Often Have Lower Interest Rates

The key reason is that they’re backed by collateral. This acts as a safety net for the lender, reducing their risk. If something goes wrong and you’re unable to repay the loan, the lender can recoup their losses by seizing and selling the collateral. Because of this reduced risk, lenders are usually willing to offer lower interest rates on secured loans, making them a more cost-effective option for borrowers.

Factors That Influence Interest Rates

- Type and Value of Collateral:

This can significantly impact the interest rate. Higher-value assets that is easy to appraise and sell, like real estate, typically results in lower interest rates. On the other hand, collateral that’s harder to liquidate might not give you as favorable a rate. - Loan Amount and Term:

The size of the loan and the length of the repayment term can also affect the interest rate. Larger secured loans or loans with longer repayment terms might come with higher interest rates to compensate for the increased risk over time. Think of it as planning a longer space mission—more time in orbit means more resources needed, so you’ll want to ensure you’re getting the best deal. - Credit Score:

Your business and personal credit scores play a crucial role in determining the interest rate. A higher credit score signals to the lender that you’re a reliable borrower, which can help you secure a lower interest rate. It’s like having a solid track record on previous missions—lenders feel more comfortable backing your journey when they know you’ve successfully navigated past financial challenges. - Market Conditions:

Interest rates can also fluctuate based on broader economic factors, such as inflation rates and market demand for loans. When the economy is booming, interest rates might rise as lenders adjust to increased demand. In quieter times, rates might be lower to encourage borrowing.

How to Secure the Best Interest Rate

- Improve Your Credit Score: Take steps to boost your credit score before applying for a loan. This could include paying down existing debt, resolving any discrepancies on your credit report, and making sure you’re paying all your bills on time.

- Offer High-Value Collateral: The more valuable and marketable your asset, the better your chances of securing a lower interest rate. Consider getting an appraisal to ensure your assets are valued correctly.

- Shop Around: Don’t settle for the first offer you receive. Compare interest rates from different lenders and consider working with a loan broker who can help you find the best deal.

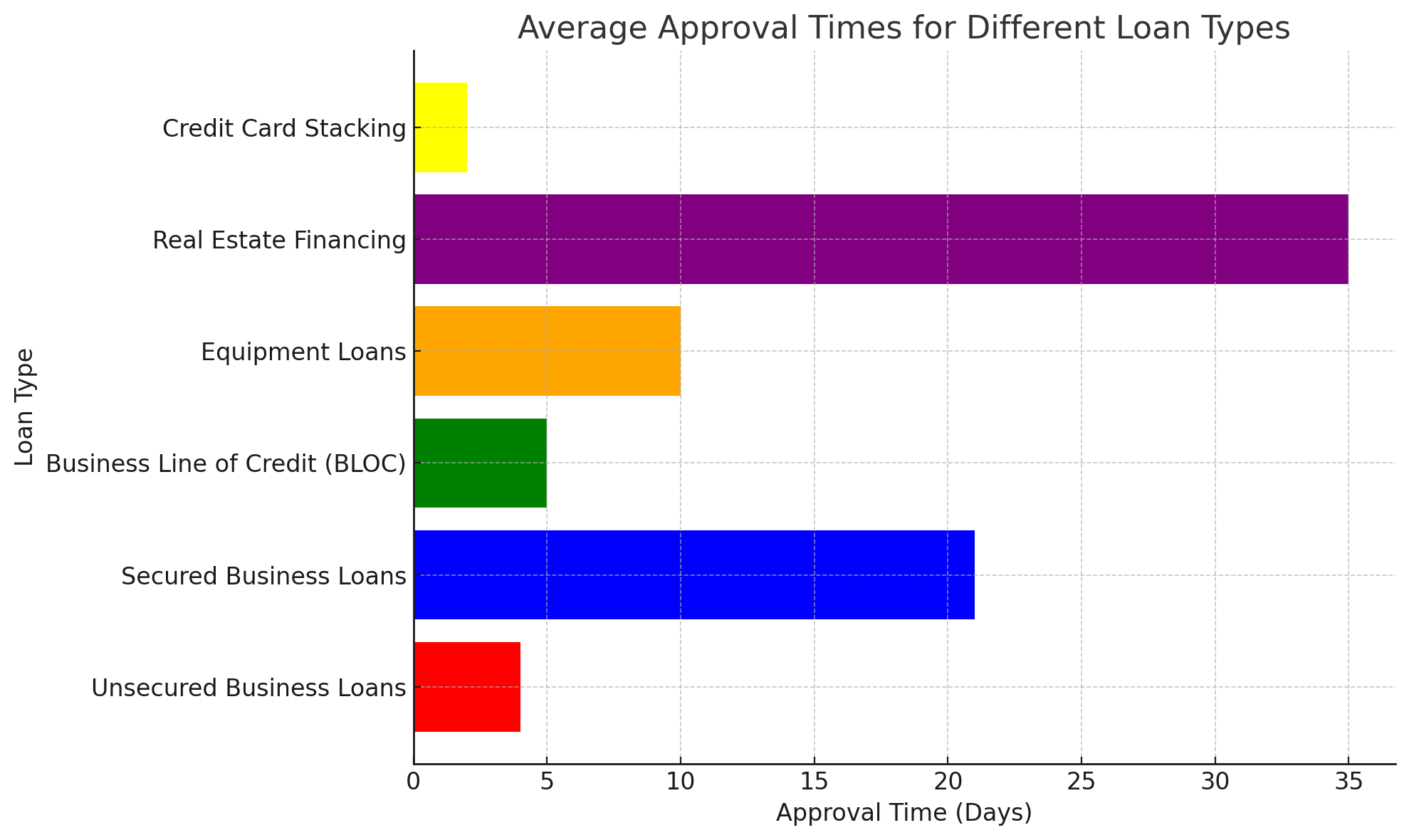

How Long Does It Take to Get Approved for a Secured Start-Up Business Loan?

Securing a business loan is a bit like prepping a rocket for launch—you’ve got to get everything in order before you can take off. One of the biggest questions on any entrepreneur’s mind is, “How long is this going to take?” The approval process for a secured business loan can vary depending on several factors, so let’s break it down and see what you can expect.

Factors That Influence Approval Time

- Type of Collateral:

The type of asset can significantly impact the approval timeline. Collateral that’s straightforward to appraise, like real estate, might speed things up, while more complex assets, like specialized equipment or inventory, could take longer to evaluate. Think of it as running a systems check—some things are quick, others require a bit more time. - Loan Amount:

Larger loan amounts generally require more scrutiny, which can extend the approval process. Lenders want to be sure that the collateral is sufficient to cover the loan and that you’ll be able to handle the repayment terms. The bigger the loan, the more thorough the review, so be prepared for a few extra steps if you’re asking for a significant sum. - Lender’s Process:

Each lender has its own approval process, and some are faster than others. Traditional banks might take a few weeks to a month, while alternative lenders could get you approved within a few days. It’s like choosing between a full pre-launch checklist and a quick systems check—both get the job done, but the time commitment varies. - Documentation and Preparedness:

How quickly you can provide the necessary documentation will also affect the approval time. If you have everything ready to go—financial statements, collateral details, and credit reports—you can speed up the process. If you’re missing documents or need time to gather them, expect delays. Being organized and prepared is like having a well-oiled launch team—everything goes smoother and faster.

Typical Approval Timelines

- Quick Approvals (1-3 Days):

If you’re working with an online lender or have a relatively small loan amount with straightforward assets, you might see approval in just a few days. This is the express lane of loan approvals—quick, efficient, and perfect for when you need funds fast. - Standard Approvals (1-2 Weeks):

For most secured start-up business loans, especially those involving traditional lenders, you can expect the process to take about 1-2 weeks. This timeline allows for thorough appraisal of your collateral and a detailed review of your financials. It’s like a standard pre-flight check—thorough, but manageable. - Extended Approvals (3-6 Weeks):

Larger secured loans, complex assets, or working with a particularly cautious lender might extend the approval process to 3-6 weeks. This is the long-haul mission—requiring patience, but ensuring that every detail is carefully checked before you get the green light.

How to Speed Up the Process

- Prepare Your Documents: Make sure you have all the necessary documentation ready before you apply. This includes financial statements, proof of collateral, and credit reports. StartCap does not require a business plan, so that’s one less thing to worry about.

- Work with the Right Lender: Choose a lender known for efficient processing times if speed is a priority. Online and alternative lenders often provide quicker turnaround times than traditional banks.

- Stay in Communication: Keep the lines of communication open with your lender. Respond promptly to any requests for additional information or clarification to avoid unnecessary delays.

The time it takes to get approved for a secured business loan can vary, but by understanding the factors at play and preparing accordingly, you can help ensure a smooth and timely process. Whether you’re in the express lane or taking the scenic route, the key is to stay organized and keep everything on track—so when the approval comes through, you’re ready to launch.

Can I Use Personal Assets as Collateral for a Secured Business Loan?

When it comes to securing a business loan, sometimes your start-up’s assets might not be enough to get the financing you need. In these cases, you might wonder if you can use personal assets as collateral to secure the loan. The short answer is yes, you can—but it’s a decision that comes with significant risks. Let’s explore how using personal assets works, what you can offer, and the potential consequences of putting your personal property on the line.

What Personal Assets Can Be Used as Collateral?

- Real Estate:

One of the most common personal assets is real estate, such as your home or other property you own. Real estate is generally high in value and relatively stable, making it an attractive option for lenders. However, putting your home on the line means that if your business hits a rough patch and you can’t repay the loan, you risk losing your property. It’s like using your safety capsule for the main mission—there’s a lot at stake. - Personal Savings or Investments:

Some entrepreneurs use personal savings accounts, certificates of deposit (CDs), or investment portfolios as collateral. These liquid assets are easy for lenders to access and can provide substantial backing for a loan. The downside? If the loan goes into default, your hard-earned savings or investments could be wiped out. - Vehicles:

Cars, boats, or other vehicles can also be used. While these assets typically don’t hold as much value as real estate, they can still be valuable enough to secure smaller loans. Just remember, if things go wrong, you might be left without a way to get from point A to point B. - Personal Property:

In some cases, you can use high-value personal property like jewelry, art, or collectibles as collateral. While these items might not be as commonly used as real estate or savings, they can still help secure a loan if they hold significant value.

The Risks of Using Personal Assets

- Personal Financial Stability:

Using personal assets as collateral puts your own financial security on the line. If your business struggles and you can’t repay the loan, you could lose these assets, which might impact your ability to cover personal expenses, save for the future, or maintain your lifestyle. - Emotional Toll:

There’s also an emotional cost to consider. Losing a family home or other treasured personal assets can be devastating, not just financially but also emotionally. It’s a tough decision that shouldn’t be taken lightly. - Limited Recourse:

If you use personal assets and default on the loan, the lender can seize those assets without much recourse for you. Unlike business assets, which might be covered by insurance or could be replaced, personal assets might not have the same protections or alternatives.

Is Using Personal Assets Worth the Risk?

It can be a viable option if you’re confident in your business’s success and need the loan to take your start-up to the next level. However, it’s crucial to weigh the risks carefully and consider how losing these assets would affect you personally. If possible, explore other options, such as using business assets or seeking alternative forms of financing, before putting personal property on the line.

Can I Refinance a Secured Business Loan?

Yes, you can refinance a secured business loan, and it can be a smart move if you’re looking for better interest rates, more favorable repayment terms, or additional capital. Refinancing involves taking out a new loan to pay off the existing one, often with the goal of improving your financial situation. Let’s explore how refinancing works, when it makes sense, and the potential benefits and risks involved.

What Does It Mean to Refinance a Secured Business Loan?

Refinancing a secured business loan involves taking out a new loan to pay off the existing one. The new loan could come from the same lender or a different one, and it typically comes with different terms—such as a lower interest rate, longer repayment period, or a larger loan amount. Essentially, refinancing allows you to adjust the financial mechanics of your loan to better suit your current situation. It’s like upgrading your rocket’s engine mid-mission to get better performance or save on fuel.

When Should You Consider Refinancing?

- Lower Interest Rates:

If interest rates have dropped since you first took out your loan, refinancing could help you secure a lower rate. This could significantly reduce your monthly payments and the overall cost of the loan. It’s like finding a more efficient fuel source—your rocket can go further without burning through your budget. - Improved Credit Score:

If your business’s credit score has improved since you first obtained the loan, refinancing could allow you to qualify for better terms. A higher credit score can lead to lower interest rates and more favorable repayment options, giving your start-up more financial flexibility. - Need for More Capital:

If your business has grown and you need additional capital to expand further, refinancing can help you access more funds. By refinancing, you can potentially increase your loan amount, providing the extra fuel you need to reach new heights. - Better Cash Flow Management:

If your current loan payments are straining your cash flow, refinancing to a loan with a longer repayment term can reduce your monthly payments. This can help free up cash for other business needs, ensuring a smoother flight for your start-up.

Benefits of Refinancing

- Cost Savings: Lowering your interest rate can save you a significant amount of money over the life of the loan.

- Increased Flexibility: Adjusting your repayment terms can help align your loan with your business’s cash flow and financial goals.

- Access to More Capital: Refinancing can provide additional funds for growth, expansion, or unexpected expenses.

Risks of Refinancing

- Costs and Fees:

Refinancing can involve closing costs, origination fees, and other expenses that could offset some of the savings from a lower interest rate. Be sure to weigh these costs against the potential benefits before deciding to refinance. - Resetting the Loan Term:

While extending your loan term can lower your monthly payments, it might also mean paying more interest over time. Consider whether the short-term relief is worth the potential long-term cost. - Risk:

Just like your original loan, the new loan will likely be secured by collateral. If your business encounters difficulties and you can’t make the payments, you still risk losing the assets you pledged.

Refinancing a secured business loan can offer significant benefits, from lowering your interest rate to accessing more capital. However, it’s important to carefully consider the costs and risks involved to ensure that refinancing aligns with your business’s long-term goals. When done thoughtfully, refinancing can give your start-up the boost it needs to continue its journey toward success, with more favorable terms and a stronger financial foundation.

Are There Any Restrictions on How I Can Use a Secured Business Loan?

Yes, there can be restrictions on how you use the funds from a secured business loan, depending on the lender and the terms of your loan agreement. While many secured business loans offer flexibility, some may require that the funds be used for specific purposes such as purchasing equipment, real estate, or inventory. Let’s dive into the potential restrictions you might face and how to ensure you’re using the loan appropriately to support your start-up’s growth.

Common Restrictions on Loan Usage

- Purpose-Specific Loans:

Some secured business loans are designed for specific purposes, like equipment financing or commercial real estate. These loans typically require that the funds be used exclusively for the intended purpose. For example, if you take out a loan to purchase new machinery, the lender may stipulate that the funds can only be used for that purchase and related expenses. It’s like being assigned a mission with a specific goal—you need to focus on that objective to successfully complete it. - Working Capital Loans:

Working capital loans are often more flexible, allowing you to use the funds for a variety of operational expenses, such as payroll, utilities, or inventory. However, even with these secured loans, some lenders might impose restrictions to ensure the funds are used to directly support business operations and not for personal expenses or unrelated ventures. Think of it as having a multi-purpose tool in your astronaut kit—you can use it in different ways, but it’s still meant for the mission at hand. - Loan Covenants:

Lenders may include covenants in the loan agreement that specify how the funds should be used and outline any restrictions. These covenants might also require you to meet certain financial ratios or maintain specific business practices. Violating these covenants could lead to penalties or even loan default, so it’s essential to fully understand and comply with them. It’s like following mission protocols—stick to the guidelines to ensure a successful and smooth operation.

How to Ensure Proper Use of Funds

- Review the Loan Agreement: Carefully read through the loan agreement to understand any restrictions on how you can use the funds. Make sure you’re clear on what’s allowed and what’s not to avoid any potential issues down the line.

- Communicate with Your Lender: If you’re unsure about whether a specific expense is covered under your loan, don’t hesitate to ask your lender. It’s better to clarify any doubts upfront than to risk breaching the loan terms.

- Keep Detailed Records: Document how you use the loan funds to ensure you’re in compliance with the loan agreement. This can be crucial if the lender ever requests proof that the funds were used appropriately.

While secured business loans can offer the flexibility your start-up needs to grow, it’s important to be aware of any restrictions on how you can use the funds. By understanding and adhering to the terms of your loan agreement, you can avoid potential pitfalls and ensure that the loan supports your business’s mission. Just like following a flight plan, sticking to the guidelines will keep your start-up on course toward success.

Remember, a secured business loan is more than just a source of funds—it’s a powerful tool that, when used wisely, can propel your business toward success. As you move forward, keep these insights in mind to make informed decisions that align with your business goals. With the right approach and the right support, your start-up’s potential is limitless. Ready to take the next step? Let StartCap be your partner on this exciting journey to success.

Community Q & A

Support@StartCap.org

Why Choose StartCAP?

Finding funding for your business isn't difficult to do, there are companies lined up begging to lend. We're unique, unlike others StartCap isn't here to fund you and wave goodbye, we build long lasting relationships ensuring your start-up gets into orbit. We're not only start-up funding specialists with more than 20 years in finance, we're also a team with more than 20 years experience as application developers, writers, marketing experts, business developers, web designers, and entrepreneurs, just like you.

Why Trust This Content?

Our writers aren't just authors of great content, they also have years of real-life experience in the actual start-up funding process. They live it day-to-day and have a wealth of hands-on knowledge that you can only get by being immersed in it. Also, our editors fact check each article, guarantee its accuracy, and make sure it follows our Editorial Guidelines before publishing.