Blast Off with Start-Up Business Loans

At StartCap, we specialize in start-up business loans and launching your new venture into the stratosphere of success. We understand that starting a new business is like preparing for an exhilarating rocket launch – thrilling, challenging, and full of potential. Our mission is to provide you with the financial fuel you need to turn your entrepreneurial dreams into reality. With more than 20 years in finance, we have the tools to get you off the launch pad.

Whether you're looking for unsecured start-up business loans, credit card stacking solutions, lines of credit, secured loans, real estate financing, or equipment loans, we've got the perfect liftoff solution tailored to your unique needs. With our expert guidance and innovative funding options, you can confidently embark on your business journey, knowing you have a trusted partner by your side.

We believe in empowering visionaries like you to reach new heights. So, strap in, set your sights on the stars, and let us help you launch your start-up into orbit. Explore our range of start-up loan options and discover how we can propel your business to success.

Unsecured

Business Loans

No Collateral Required

Starting a new business is exciting, however, securing financing can be a challenge, especially if you don't have collateral. Our unsecured start-up business loans provide the flexibility and freedom you need to ignite your venture without the need for collateral.

Benefits

Eligibility

Application Process

Business

Credit Card Stacking

Maximize Your Funding

Credit card stacking is a powerful financing strategy that allows start-ups to access multiple credit lines by leveraging various credit cards. This method can provide the necessary funds to fuel your growth without a single large loan or large payment.

How It Works

Advantages

Steps To Apply

Business

Line of Credit

Financial Flexibility

A business line of credit (BLOC) provides start-ups with a flexible funding solution that can adapt to their ever-changing needs. Unlike traditional loans, you only borrow what you need, when you need it, and only pay interest on the amount used.

Flexibility

Requirements

Typical Uses

Application Process

Secured

Business Loans

Leverage Your Assets

If your start-up has valuable assets, you can leverage them to secure a loan with better terms. Secured start-up business loans offer lower interest rates and higher loan amounts by using assets as collateral.

Benefits

Security Options

Application Details

Plus — you'll get a ton of FREE stuff.

For a very limited time and to really kick-start your business, our internal expert marketing team is going to give you 3-Months of FREE top-tier professional marketing to drive leads & sales.

Free Domain Name

Free Custom Website

Free Logo Design

Free Google Ads Management

Free Social Media Management

Free GMB Setup & Optimization

Free Professional SEO

Free Web Hosting

Free Directory Listings (100+)

That's $20k+ in free marketing + up to $500k in funding for everything else.

What Interest Rates Can I Expect for Start-Up Business Loans?

The interest rates for start-up business loans can vary widely, typically ranging from 5% to 29%, depending on factors such as the type of loan, the lender, and your creditworthiness. Those with excellent credit and choose to use credit cards or stacking often receive 0% interest for up to two years. While this is an amazing offer, there are risks and understanding these variables can help you secure the best possible rate & terms for your needs.

Note: We would like to formally apologize for our rocket humor in advance, yes, we're a bit ridiculous sometimes...

Understanding Interest Rates

Interest rates are like the gravitational pull of your business loan—always present, always affecting your trajectory. They're the cost of borrowing money, expressed as a percentage of the loan amount, and they can significantly impact the overall cost of your loan. For start-up business loans, interest rates can vary widely based on several factors, including the type of loan, the lender, and your creditworthiness.

Factors Influencing Interest Rates

Type of Loan

- Unsecured Start-Up Loans: These loans don't require collateral, making them riskier for lenders—think of it as launching without a safety net. As a result, they typically come with higher interest rates. Imagine the interest rates here as meteors you have to dodge: they can be high, often ranging from 7% to 29% depending on your credit history and business revenue or personal income.

- Secured Start-Up Loans: These loans require collateral, such as real estate or equipment, which acts as a planetary shield, reducing risk for lenders. Consequently, interest rates are lower, usually between 5% and 15%. Secured loans are like having a trusty space probe; they give you more stability and lower costs.

- Lines of Credit: These flexible options, akin to having extra fuel tanks, usually come with variable interest rates between 5% and 20%. You can draw from them as needed and only pay interest on what you use, making them perfect for managing cash flow.

- Credit Card Stacking: This strategy involves leveraging multiple cards to maximize your available limit. Interest rates can vary widely based on the cards you obtain, typically ranging from 12% to 25%. It’s like having a cluster of smaller thrusters to fuel different parts of your business.

- Equipment Loans: If you need to purchase specific tools or technology, these loans offer rates between 6% and 16%, giving you the power to upgrade your spacecraft. They are secured by the equipment you purchase, often resulting in lower interest rates.

- Real Estate Loans: Used for purchasing commercial property, these loans generally have rates between 4% and 12%, similar to having a solid launch pad for your business operations. The property itself serves as collateral, which helps in securing lower rates.

Creditworthiness

Your personal and business credit scores are like your rocket's thrusters—the higher they are, the smoother your journey. A strong score can help you secure lower interest rates, while a lower score might send your rates into orbit. Lenders typically look for a credit score of 650 or higher, but the better your score, the better your rate.

Business Plan and Financial Projections (neither are required with StartCap)

A solid business plan and clear financial projections are your star maps, guiding lenders through your potential success. The more detailed and promising your plan, the more likely you are to get favorable rates. Show them you've plotted your course through the stars, and they'll be more confident in offering lower rates.

Loan Amount and Term

The amount you borrow and the term of the loan also influence the interest rate. Larger loans or longer terms might come with higher rates to compensate for the increased risk. It's like planning a long space voyage—the further you go, the more resources you need, and the more it might cost.

Average Interest Rates for Start-Up Loans

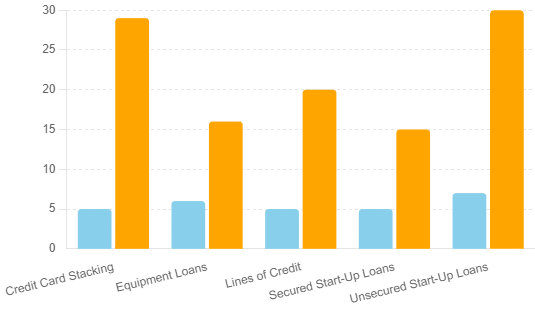

Now, let's ground ourselves with some average interest rates you can expect for different types of start-up loans:

- Unsecured Start-Up Loans: These are your high-risk, high-reward options, with rates typically between 7% and 29%.

- Secured Start-Up Loans: More stable and secure, with rates ranging from 5% to 15%.

- Lines of Credit: These flexible options, akin to having extra fuel tanks, usually come with variable interest rates between 5% and 20%.

- Equipment Loans: If you need to purchase specific tools or technology, these loans offer rates between 6% and 16%, giving you the power to upgrade your spacecraft.

- Credit Card Stacking: These are some of the best types of funding for pre-revenue & early stage start-ups, many having 0% interest for up to 2-years. Then, they're usually between 5% - 29% depending on your credit history & revenue. The great thing is that they're revolving and you only pay for what you use. Many even offer low fee bank transfers for quick liquidity.

Chart depicting the differences in credit & loan types vs average interest rate minimums & maximums.

Tips for Securing Lower Interest Rates

To avoid getting lost in the financial asteroid belt, here are some tips to help you secure the best possible interest rates:

- Boost Your Score: Pay down debts, correct any errors on your credit report, and maintain a good history.

- Consider Collateral: If possible, offer collateral to secure a lower interest rate.

- Shop Around: Compare rates and terms from multiple lenders to find the best deal. At StartCap, we do this for you automatically and provide you with your options.

- Term: Remember, a shorter term length means that you'll pay less compounding interest over time.

Can I Use Start-Up Business Loans to Cover Ongoing Operational Costs?

Yes, you can use a start-up loan to cover ongoing operational costs. Start-up loans are versatile financial tools that can help ensure your business has the necessary resources to maintain smooth operations, beyond just the initial expenses. Let's delve into how these loans can be utilized to manage your day-to-day expenses and keep your entrepreneurial journey on track.

Covering Operational Costs with Start-Up Loans

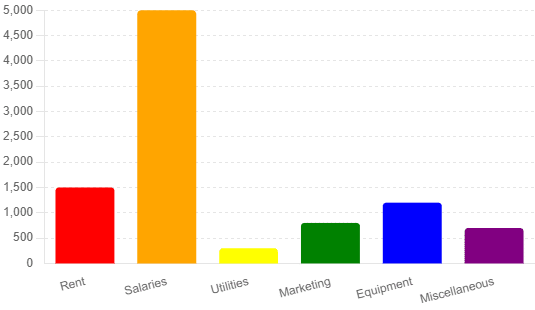

Operational costs are the fuel that keeps your business rocket in orbit. These include:

- Payroll: Paying your team of astronauts (employees) who help steer your business toward success.

- Rent: Leasing the mission control center (office or retail space) where your operations are based.

- Utilities: Keeping the lights on and the communication lines open.

- Inventory: Stocking up on products or materials needed to fulfill customer orders.

- Marketing: Promoting your business to attract new customers and retain existing ones.

- Software and Subscriptions: Essential tools and services that streamline your operations.

Chart showing average monthly operational costs for starting a new business

Types of Start-Up Loans for Operational Costs

Several types of start-up loans can be used to cover these ongoing expenses:

- Unsecured Start-Up Loans: These loans don’t require collateral and can be used for various operational costs. They provide a lump sum of cash that you can allocate as needed to keep your business running smoothly.

- Lines of Credit: An LOC is like having a flexible reserve of funds. You can draw from it whenever you need to cover operational costs and only pay interest on the amount you use. This is ideal for managing cash flow and handling unexpected expenses.

- Card Stacking: By strategically using multiple business credit cards, you can access a significant amount of funds to cover day-to-day expenses. This method allows you to spread costs across several cards, providing flexibility in managing your budget.

- Working Capital Loans: Specifically designed to cover short-term operational costs, working capital loans provide the funds needed to maintain daily operations. These loans are typically repaid within a year and are useful for bridging gaps in cash flow.

Pros and Cons of Using Start-Up Loans for Operational Costs

Pros:

- Immediate Access to Funds: Start-up loans can provide the necessary capital to cover operational expenses right when you need it.

- Flexibility: Funds from start-up loans can be allocated to various operational needs, allowing you to address immediate financial demands.

- Cash Flow Management: Helps maintain a healthy cash flow by covering routine expenses without straining your available cash reserves.

- Growth Opportunities: By ensuring operational costs are covered, you can focus on growth initiatives and long-term business strategies.

Cons:

- Debt Accumulation: Taking on a start-up loan means accumulating debt, which must be managed and repaid.

- Interest Costs: Loans come with interest, increasing the overall cost of borrowing.

- Repayment Pressure: Regular loan repayments can add financial pressure, especially if your business is not generating consistent revenue.

- Qualification Requirements: Securing a loan requires meeting certain criteria, which might be challenging for some start-ups.

Tips for Managing Operational Costs with a Start-Up Loan

To make the most of your start-up loan, consider the following tips:

- Create a Detailed Budget: Outline all your operational costs and allocate funds accordingly. A well-planned budget will help you manage your loan effectively.

- Prioritize Expenses: Identify the most critical expenses that need immediate attention and prioritize them. This ensures that essential operations continue without disruption.

- Monitor Cash Flow: Keep a close eye on your cash flow to ensure you’re not overspending. Regularly review your financial statements and adjust your budget as needed.

- Communicate with Your Lender: Maintain open communication with your lender. If you foresee any issues with repayment, discuss them proactively to explore possible solutions.

Does a Start-Up Business Loan Impact My Personal Credit Score?

Yes, a start-up business loan can affect your personal score. The impact depends on various factors, such as the type of loan, how you manage the repayments, and whether the loan is reported to personal credit bureaus. Let's break down how this works and what you can do to manage it effectively.

Initial Credit Check

When you apply for a start-up business loan, the lender will typically perform a check to assess your creditworthiness. This inquiry can be either a hard or soft:

- Hard Inquiry: This type of inquiry can temporarily lower your score by a few points. It's a standard part of most loan applications where the lender reviews your credit report in detail.

- Soft Inquiry: This has no impact on your score and is often used for prequalification purposes.

While a single hard inquiry might only slightly impact your score, multiple hard inquiries in a short period can have a more significant effect.

Note: StartCap requests a soft pull to pre-qualify you for any loan or credit options are provided. This does not impact your personal score. Upon acceptance of some loans, credit lines, or cards, the bank will perform a hard pull before providing funding.

Loan Approval and Utilization

Once approved for a start-up business loan, how you manage the loan can influence your personal score in several ways:

- Utilization Ratio: If your loan is reported to the bureaus, it will affect your utilization ratio, which is the amount of credit you're using compared to your total available limit. A higher ratio can negatively impact your score.

- Payment History: Consistently making on-time payments can positively affect your score since payment history is a significant factor in scoring models. Conversely, late or missed payments can significantly harm your score.

Types of Loans and Their Impact

The type of start-up business loan you choose can also influence your personal credit score differently:

- Secured Loans: These loans require collateral and might not affect your personal score if the loan is only reported to business bureaus. However, if you default, the lender might seize your collateral, and your personal credit score could still be affected.

- Unsecured Loans: These loans do not require collateral but are more likely to be reported to personal credit bureaus, directly impacting your score.

Personal Guarantees

Many start-up business loans require a personal guarantee, especially if your business lacks a strong history. A personal guarantee means that you, as the business owner, are personally responsible for repaying the loan if the business cannot. This can directly impact your personal credit score because:

- Defaulting on the Loan: If the business fails to make payments, the responsibility falls on you, which can lead to negative marks on your credit report.

- Co-Signing Risks: If you co-sign for a business loan, the debt will appear on your credit report, affecting your debt-to-income ratio and utilization.

Managing the Impact

To minimize the potential negative impact on your personal score, consider these tips:

- Maintain Timely Payments: Always make loan payments on time to build a positive payment history.

- Monitor Reports: Regularly check your credit reports for accuracy and to stay aware of how your loan affects your score.

- Separate Finances: Where possible, keep your business and personal finances separate to avoid cross-impact.

- Consider Loan Type: Choose the type of loan carefully based on how it will be reported to the bureaus and its potential impact on your score.

A start-up business loan can affect your personal score, but the extent of the impact depends on various factors, including the type of loan, how you manage the repayments, and whether the loan is reported to personal credit bureaus. By understanding these dynamics and managing your loan responsibly, you can mitigate negative effects and even use the loan to build a stronger credit profile.

Can I Apply for Multiple Start-Up Business Loans & Credit Lines at the Same Time?

Yes, you can apply for multiple start-up business loans & lines simultaneously, it's called stacking. Combining different loans and types can significantly increase your overall funding, providing more capital to fuel your business ambitions. At StartCap, we automatically provide you with all of your stackable options up front, then you can choose how you would like to proceed. However, this approach comes with additional risks that you need to consider.

Benefits of Multiple Loans

Applying for multiple loans can offer several advantages:

- Increased Funding: By securing multiple loans, you can access a larger pool of funds than a single loan might provide. This can be especially useful for covering diverse expenses like equipment, marketing, and operating costs.

- Flexible Use of Funds: Different loans might be tailored for specific purposes. For instance, one loan could cover your immediate cash flow needs, while another might be used for long-term investments.

- Diversified Loan Types: Combining secured and unsecured loans, lines of credit, and other financing options can help you optimize your funding strategy and manage financial risks more effectively.

Risks and Considerations

While the benefits are appealing, there are also several risks and considerations to keep in mind:

- Higher Debt Levels: Taking on multiple loans increases your overall debt, which can strain your business’s cash flow and make it harder to meet repayment obligations.

- Complex Repayment Schedules: Managing different loans with varying repayment terms and interest rates can be challenging and may increase the risk of missed payments.

- Impact on Score: Each loan application typically involves a credit check, which can temporarily lower your score. Additionally, the increased debt load can affect your utilization ratio, potentially impacting your score.

- Increased Financial Risk: With more loans, the financial risk to your business grows. Defaulting on one or more loans could have severe consequences, including asset seizure if collateral is involved.

Strategies for Managing Multiple Loans

If you decide to pursue multiple start-up business loans, consider these strategies to manage them effectively:

- Create a Detailed Budget: Plan how you will use the funds from each loan and ensure you have a clear repayment strategy for each one.

- Monitor Cash Flow: Regularly track your business’s cash flow to ensure you can meet all repayment obligations without compromising your operations.

- Consolidate Debt: If managing multiple loans becomes too complex, consider consolidating them into a single loan with more favorable terms.

- Communicate with Lenders: Maintain open communication with your lenders. If you encounter financial difficulties, they may offer solutions like adjusting repayment terms.

Community Q & A

Support@StartCap.org

Why Choose StartCAP?

Finding funding for your business isn't difficult to do, there are companies lined up begging to lend. We're unique, unlike others StartCap isn't here to fund you and wave goodbye, we build long lasting relationships ensuring your start-up gets into orbit. We're not only start-up funding specialists with more than 20 years in finance, we're also a team with more than 20 years experience as application developers, writers, marketing experts, business developers, web designers, and entrepreneurs, just like you.

Why Trust This Content?

Our writers aren't just authors of great content, they also have years of real-life experience in the actual start-up funding process. They live it day-to-day and have a wealth of hands-on knowledge that you can only get by being immersed in it. Also, our editors fact check each article, guarantee its accuracy, and make sure it follows our Editorial Guidelines before publishing.